Frequently Asked Questions

Who can apply for the loan?

All Malaysian citizens above 18 years old can apply for the loan.

How do i apply for the loan?

After you download and register as a user of the Wavpay Credit App, you can apply the loan via the App. You need to indicate the loan amount and repayment period and other personal details for us to process and approve your loan application.

How do I access the Wavpay Credit App?

You can access the Wavpay Credit App by downloading from App Store such as Playstore or IOS. You also can access the Wavpay Credit loan application service via the Wavpay e-wallet.

How much can I borrow?

You can borrow between RM2,000 to RM5,000 depending on your repayment capacity, to be evaluated by Wavpay Credit Sdn Bhd.

Do I need to provide documents during the loan application?

Yes, you will be guided with the documents to be uploaded into the Wavpay Credit App. Typically, the documents required are:

- MyKad photo

- Last 3 months salary slip, if you are an employee

- Latest income tax statement

- Latest 6 months bank statements, if your income is not from employment

If I have CTOS record, am I entitled to apply for the loan?

Yes, we still process your loan application however there may be changes in the approved loan amount, repayment period, interest rate or any other terms and conditions.

How long my loan application will be approved?

Your loan will be approved within 24 hours if all information submitted is sufficient for our processing.

Can I apply for loan if I am not a Wavpay e-wallet user?

Yes, you can. However, you still need to register as a Wavpay e-Wallet user for us to disburse the approved loan amount into your e-wallet.

Do I need a collateral or guarantor for my loan to be approved?

No, you don’t. For time being, Wavpay Credit offers unsecured loan to applicants using the Wavpay Credit App.

How do I repay my loan?

After your loan is approved, you need to give consent for the deduction of monthly instalment amount from your bank account using the e-mandate facility provided in the Wavpay Credit App. The facility will auto deduct the amount on the date of deduction. You will receive the proof of repayment within the statement and inbox message in your Wavpay Credit App.

How is the interest rate calculated?

Yes, you can. You need to contact us via the following telephone, fax or email to request for early loan settlement:

Tel.: +603 7613 3047

Fax: +603 7613 3450

Email: general@wavpaycredit.com.my

Can I early settle my loan?

Yes, you can.

I want to get a loan for my business. Can I apply under the business name?

Yes, as long as your business is a sole-proprietor registered under your name with SSM.

If I submit my personal information, is it safe?

Yes, we are governed by the following:

- Personal Data Protection Act 2010 (under moneylending category)

- Digital Signature Act 1997

Can I keep my loan agreement?

Yes, you can. Your stamped loan agreement will be made available to you in non-editable PDF format within the BorroWang App. You can view and download the agreement anytime, anywhere.

Is my loan agreement stamped?

Yes, your loan agreement is stamped under the requirement of the Moneylenders Act 1951 governed by the Kementerian Perumahan dan Kerajaan Tempatan (KPKT).

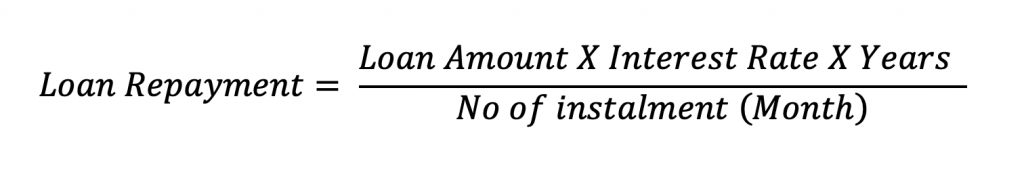

How do I calculate loan repayment?

Your loan repayment is calculated using the formula as follows:

How do I receive the loan amount?

Wavpay Credit Sdn Bhd will disburse the loan amount into your Wavpay e-wallet. Please check your e-wallet balance upon confirmation in the BorroWang App that the amount has been disbursed.

If I fail to pay my loan instalment, is there any penalty?

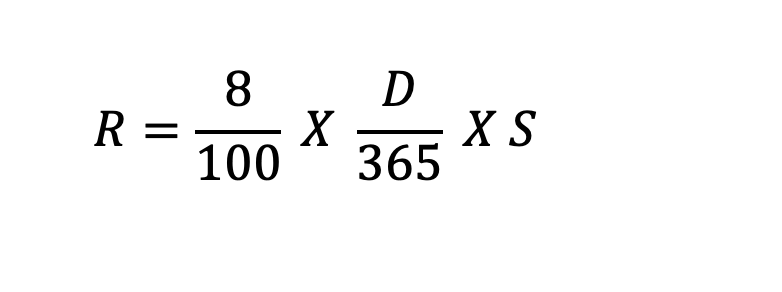

Yes. The penalty will be calculated based on 8% interest on the unpaid instalment using simple interest calculation method on the amount upon due from day to day until payment is made. The calculation is as follows:

R Represents sum of interest paid

D Represents the number of days in default

S Represents the sum monthly instalment which is overdue.

Where can I view my loan statement?

You can view your loan statement in the Wavpay Credit App.

How do I keep track of my loan repayment status?

You can track your loan repayment status in the Wavpay Credit App. You can see the repayment status of your individual loan and also the repayment status of the entire loans with Wavpay Credit Sdn Bhd.